Every Baby Deserves a Chance

Be the reason a woman chooses life — donate today and offer hope, care, and a future to families across Arizona.

Her car became her refuge—and her breaking point.

Because of donors like you, her story didn’t end in despair—it began with hope, truth, and the chance to choose life.

Your gift today ensures the next woman doesn’t face her moment of uncertainty alone. Whether one-time or monthly, your support delivers compassion, and GREATER LOVE where it’s needed most.

Give securely by credit card, debit, or ACH—whatever works best for you.

It was long past midnight when the weight of it all became impossible to ignore.

She sat alone on the edge of her bed, searching for answers, searching for hope.

The choice before her felt too heavy to carry alone.

She had nowhere to turn… until she found Choices.

With your generosity, her story didn’t end in isolation or fear. She received answers and hope.

Your gift today ensures the next woman who feels lost in the dark finds light. Whether one-time or monthly, your generosity delivers GREATER LOVE in life’s most uncertain moments.

To give by check, please make checks payable to Choices Pregnancy Centers and mail them to:

Choices Pregnancy Centers

10555 N 58th Drive

Glendale, AZ 85302

Fear clouded her future the moment she saw the test.

But with love, education, and support—light broke through. You can be that light for the next woman facing an unplanned pregnancy. A gift of appreciated stock not only avoids capital gains—it powers life-saving care when it’s needed most.

Invest in hope. Give stock. Help her choose life.

One call changed everything. Your support made it possible.

She felt trapped—until a voice on the line brought peace to her panic. That moment of calm, care, and life-saving support was made possible by donors like you.

Now, you can be that miracle for someone else.

Your crypto gift delivers hope when it matters most. It’s fast, secure, and comes with significant tax advantages.

We accept Bitcoin, Ethereum, and most major cryptocurrencies. Donate today—help her choose life.

It wasn’t just a pregnancy test—it was a turning point.

She came in afraid. She left with a plan, a smile, and support she never imagined. That transformation happens because people like you choose to give. Your DAF gift powers ultrasounds, counseling, parenting support, and hope—right when it’s needed most.

You’re not just funding services—you’re changing futures.

Recommend a grant today through Fidelity, Schwab, NCF, or your preferred DAF provider.

Simple. Impactful. Aligned with your values.

Are you already a donor? Because of You, Hope Lives Here.

Your generosity changed everything. A young woman in crisis didn’t walk alone—because you made sure someone was there. She was heard. She saw her baby’s heartbeat. She found the strength to choose life. Thank You!

But every day, another woman stands at that same crossroads—scared and unsure where to turn. That’s where you come in again.

Your continued support brings truth, hope, and LIFE—right when it’s needed most. Whether a one-time gift or a monthly commitment, every dollar extends the life-saving impact you’ve already begun.

Give again today—and help more women walk from fear to freedom.

You Can Make A Difference

What Our Clients Say…

“Definitely one of the best experiences I’ve encountered. Staff is extremely welcoming and kind.”

“This experience was amazing…I feel a new sense of confidence leaving this office that I did not have walking in. Thank you!”

“Very helpful and friendly! Love love love it here. It’s awesome, everything you guys offer.”

Stewardship of Your Life Changing Gifts

One of our Core Values at Choices is Stewardship. We are serious about our mission and vision and the generosity that supports saving lives. We protect and use what God has given us with the utmost fiscal responsibility.

Empowering Families through AZ's Tax Credit

$495 single, married filing separate or head of household

$987 married filing joint

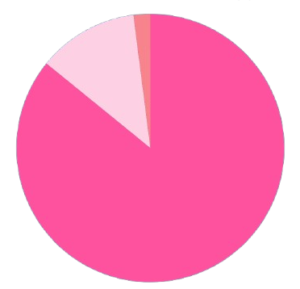

See Where Every Dollar Goes

85¢ of Every Dollar Fuels Our Mission

Accountability You Can Believe In

QCO# 20684

Arizona Qualifying Charitable Organizations (QCOs) are certified nonprofits that allow taxpayers to receive dollar-for-dollar state tax credits for donations. Donors must use specific QCO codes provided by the Arizona Department of Revenue to claim this credit on Form 321.